US Elections – Implications for Emerging Market Equity

Two candidates, 50 states, over 150m projected votes cast, and an estimated $6bn in cost – the US presidential election is an outstanding political event, with consequences that will ripple through economies globally.

For Emerging Markets (EM), with a Trump presidency, market noise is about to get radically cranked up. The shake-up of a new administration brings the near certainty of near-term uncertainty, and yet this is also all familiar terrain in that both the candidate and the cycle are known. Against this backdrop, despite a likely rise in geopolitical tension, we believe that Emerging Markets have some of the most attractive bottom-up opportunities of any asset class given current valuation extremes.

The EM presidential playbook

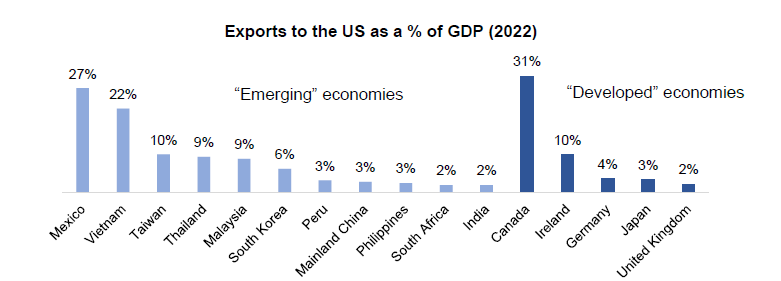

Fundamentally, the impact of a new Trump administration is a net negative for EM corporates, although the nature and degree vary greatly between markets. One of Trump’s headline commitments has been to implement a 10% tariff on all imports, and a 60% tariff specifically on Chinese imports. This would be highly disruptive to global trade, and indeed inflationary for the US. Analysis by the Peterson Institute for International Economics concludes that were this level of tariffs applied, it would raise US 2025 inflation by two percentage points, increase average US household spending by $2,600 a year, and ultimately (due to retaliation) reduce GDP by 1%. For Emerging Markets, beyond the immediate impact on commerce, there would be a long host of second- and third-order effects, making any longer-term readthrough on impact challenging.

Source: Tellimer Research, Oldfield Partners.

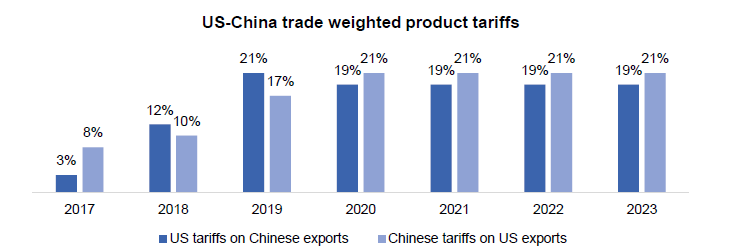

The good news is that we already have a playbook to help us steer through probable events. During the 2016 campaign, Trump committed to a 45% tariff on Chinese imports and 35% tariff on Mexican imports. The outcome, however, was considerable compromise, and consequently a lower tariff on a limited number of products. The US average tariff on Chinese exports (trade weighted product tariff) rose to just below 20%, and China responded in kind. Exporters in China suffered, but there were also beneficiaries. Second-order effects included a fresh policy rigour in China to develop domestic industry and IP, plus a nourishing of close relationships with other developing nations.

Source: Peterson Institute for International Economics, Oldfield Partners.

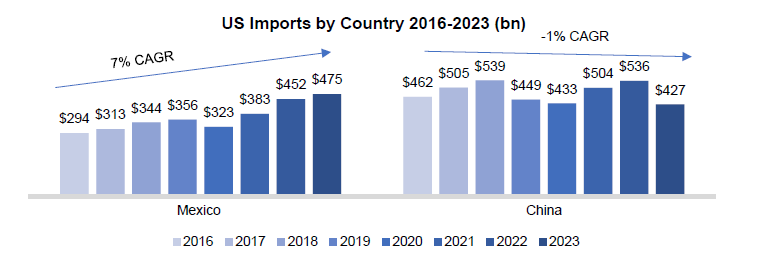

In the case of Mexico, the North American Free Trade Agreement (NAFTA) was replaced with the US-Mexico-Trade Agreement (USMCA). Again, the impact was negative, but not overwhelmingly so. Indeed, one of the second-order effects of the previous Trump administration’s diplomatic approach was that Mexican-US trade has since flourished, as geopolitical concerns about China provoked a near-shoring of low-end industrial activity.

Source: Source: United States Census Bureau, Oldfield Partners.

The valuation landscape

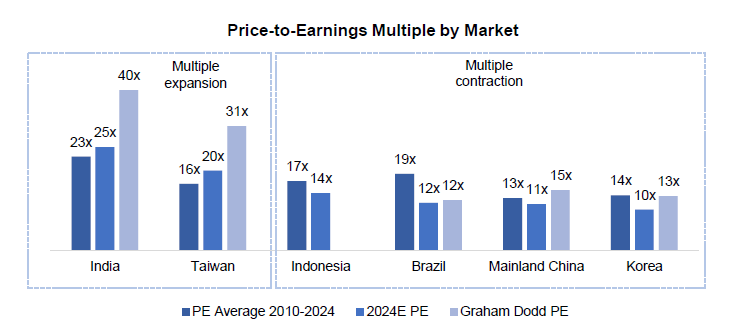

Beyond the clamour of corporate activity, is the more significant determinant of actual investor returns – valuations. This is where we become far more buoyant about prospects. The headline valuation multiples for EM not only appear “cheap” on a relative basis, but heavily understate the wide range between distress and excess amongst markets.

Source: Company data, Bloomberg, Oldfield Partners, Price as at November 6th 2024.

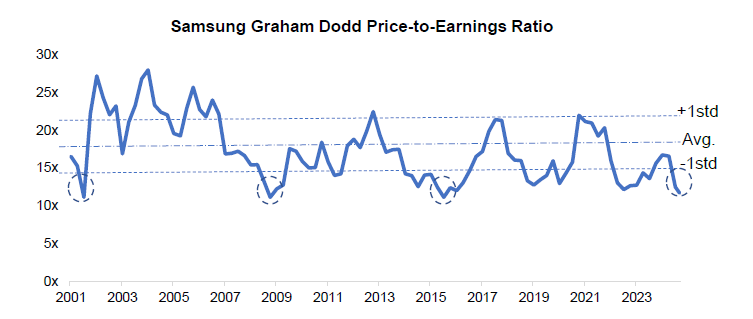

This dispersion becomes even more extreme at the stock level – an exciting starting point for the bottom-up value investor. For example, the Portfolio’s holding in Indonesia consumer staple Indofood trades at a valuation multiple nearly one-tenth of Indian equivalents. Valuations have also decoupled when compared with historic ranges. It is true both that some EM companies are trading at valuations nearing their historic highs, and that some are trading near multi-decade lows. For example, Korean multinational Samsung has been established for almost a century, has a robust business model, and a considerable net cash balance. The firm now trades at a Graham Dodd PE of below 12x, a level historically consistent with strong subsequent returns. Indeed, following past periods in which the valuation has reached this level (2001, 2008 and 2015), the share price has more than doubled in the following 12 months. History will not necessarily repeat, hence a diversified portfolio of 21 positions, but it does heavily stack the deck in our favour.

Source: Company data, Bloomberg, Oldfield Partners, Price as at November 7th 2024.

Facts over Fortune Telling

Warren Buffett is often quoted in his advice to investors “to be fearful when others are greedy and to be greedy only when others are fearful.” We do not make grand predictions on future events, but we see a deep investor fear implied by the valuation levels across parts of the Emerging Markets universe, and are very much inclined to be greedy. The coming few years, in terms of market efficiency, may be more “erratic dash” than “random walk”, but they contain, we believe, the long-term opportunities for a disciplined bottom-up value investor.