Korean Chaebols – Governance Reform

Korean holding companies (the Chaebols) may have historically been as a dull as a butter knife, but efforts are now underway to put pressure on these gratuitously convoluted corporations to better realise shareholder value. A radical rise in retail participation within the local equity market and the positive experience of governance reforms in Japan have all been noted by Korean policymakers. This has roused a renewed focus on improving domestic capital market conditions with governance reform.

Preferring numbers over narratives, we remain cautious that policymakers can really take a grip over these bloated plutocracies, and yet valuation discounts in some cases remain so severely depressed that any positive momentum could yield transformative results for shareholder returns.

Barbarians at the Gate

The Chaebols originated in the 1960’s when the government provided extensive subsidies, incentives and loans to certain preferred sectors. This gave rise to a clique of around 20 family controlled corporate behemoths that would go on to largely spearhead Korea’s economic transformation over the decades ahead. Amongst these, major names include Samsung, LG, SK and Hyundai – vast businesses with sprawling operations across disparate markets. Outside of Samsung Electronics for example, Group operations include a theme park, ship building, construction and life insurance; LG Corp meanwhile, beyond white goods produces products ranging from commodity chemicals through to high-end cosmetics. These firms have serious reach, and with it substantive economic and political clout.

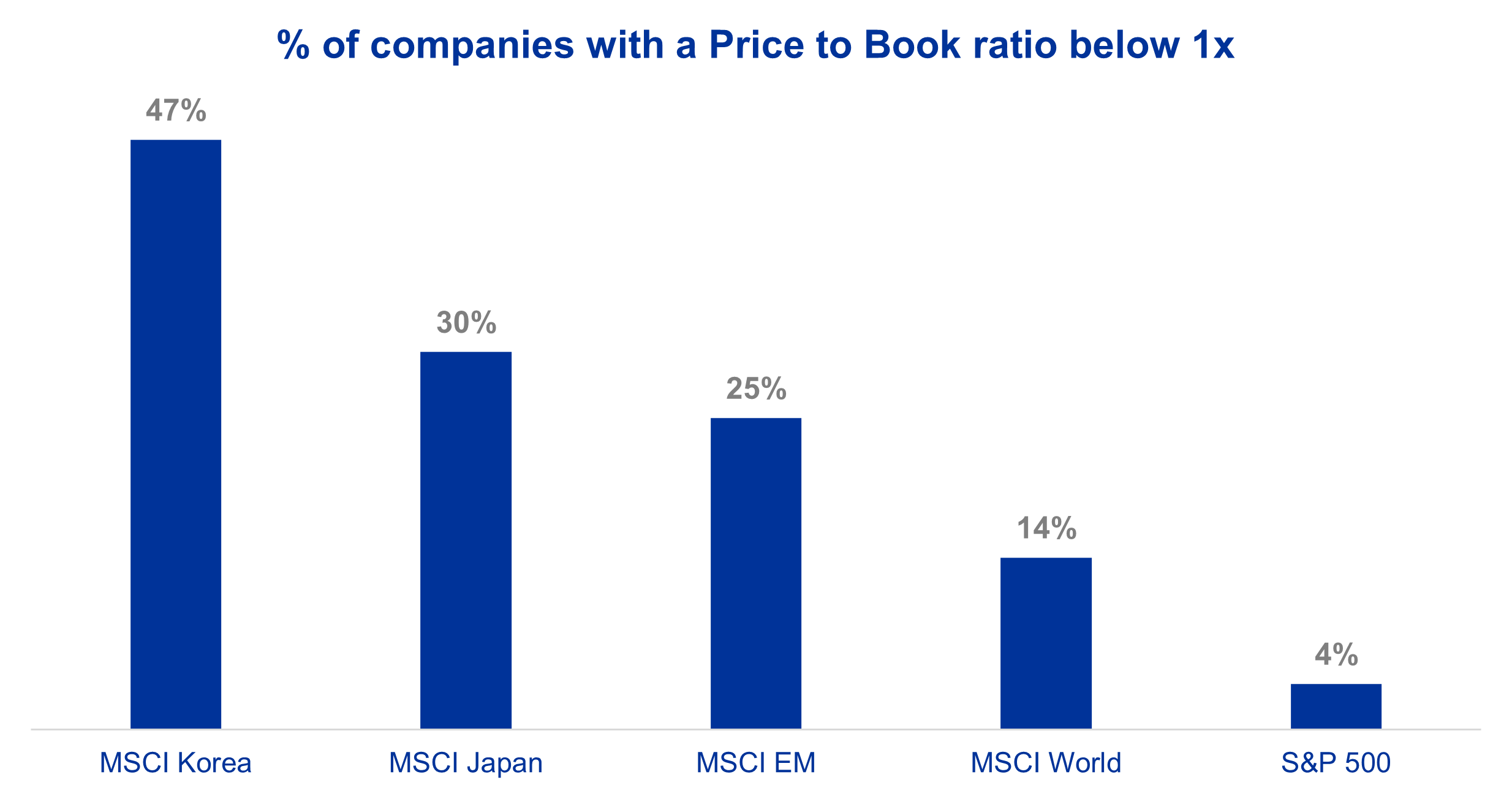

Chaebols have however outlived their use. Largely, developing into unwieldly opaque corporate structures, these groups might have made sense during a period when funding for smaller firms was heavily constrained, but that argument is now redundant given the leap forward in capital market development across Korea. Indeed, in the US where the conglomerate structure also flourished in the 1960’s, that wave crashed with the 1980’s rise of corporate raiders. These ‘predators’, vilified in books/films such as Wall Street and Barbarians at the Gate, were able to generate exorbitant profits by splitting conglomerates into their separate parts for independent sale, (often at the expense of jobs). Korea is a world away from experiencing such hostile activism, but likewise given the absurdity of the discounts at which Chaebols largely trade, often at under half their Net Asset Value, even minor improvements off a low base can make a big difference.

Source: MSCI, Bloomberg, August 2024

Dismantling the discount

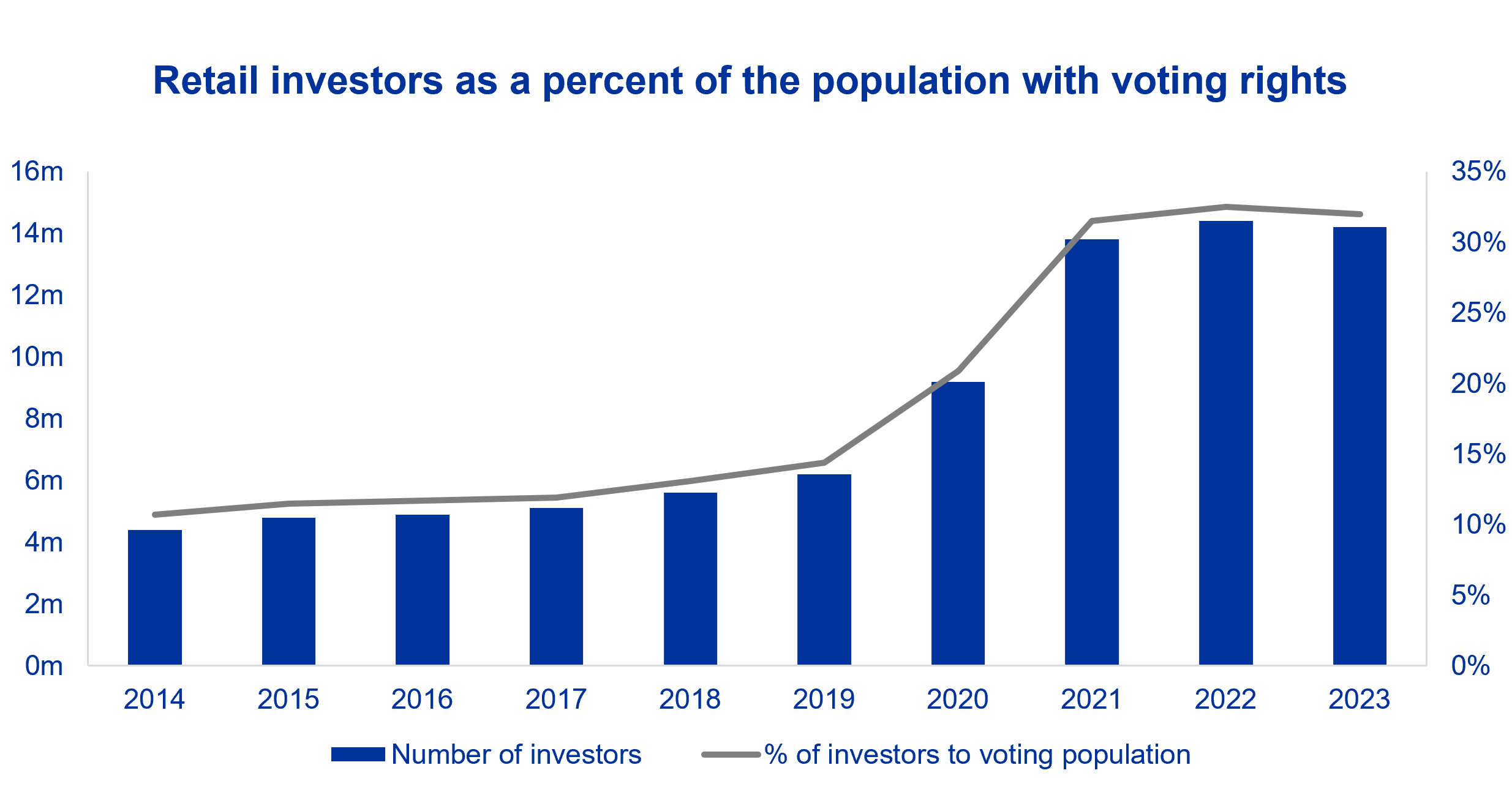

In the past, there have been several efforts to reduce the so called ‘Korea discount’, however, these have proven as vacuous as a Eunuchs pants (to paraphrase Blackadder), as legislative inertia and partisan politics have restricted the rubber ever truly hitting the road. While apprehensive that this time will be different, there is now notably more evidence that change might be afoot. Chief amongst these reasons is the positive experience of reform in Japan, propelling the stock market to new highs earlier in the year – something that has not gone unnoticed in Korea, a close competitor. Moreover, there has been a dramatic rise of retail participation within the equity market. Over the last decade, as per data from the Korea Securities Depository, the number of stock market investors is estimated to have tripled, doubling between 2018-2023 alone. Retail investors now account for approximately one-third of the voting population, vaulting the issue of depressed valuations onto the political stage, broadening the appeal for change and subsequently creating greater bi-party support for investor friendly policy.

Source: CLSA, Korea Securities Depository, 2023

The result has been the introduction of the ‘Value Up Program’. Unveiled in February 2024, the initiative is a set of proposed reforms to encourage shareholder returns through incentives. These have so far included tax benefits, and encouraging listed companies to voluntarily set up and disclose valuation enhancement plans. While directionally these are all important steps and there have been some green shoots of progress, there are also challenges to overhauling corporate culture. One of the greatest obstacles is alignment. Korea has an inheritance tax rate of up to 50%, amongst the highest globally, this makes the calculation for the controlling families complex, as a deflated valuation can work heavily in their favour come the death of a family member. When former Samsung Chairman Lee Kun-hee was announced dead for example, shares in Samsung C&T and Samsung Life morbidly shot up 21% and 16% respectively, due to the investor expectation that a reorganisation of the sprawling conglomerate was finally in sight.

Giving more bite to their bark

Positive progress on governance reform is a good start, but there is significantly more that could be done to truly shift the Korean capital markets into gear. Key proposals that we would like to see can be summarised into two categories, prods and protections. Key prods to realise value include an actual regulatory requirement that directors in the annual report include a clear proposal with measurable interim objectives to realise shareholder value, and specifically address balance sheet capital management. Cancelling treasury shares, buying up deeply discounted preference shares and adopting a reasonable dividend policy would all be quite easy wins that would yield big valuation gains for most Chaebols.

There are also a range of protections we would be keen to see implemented to safeguard minority interests. For example, requiring separate minority shareholder approval for related party transactions and share swaps, plus mandating a ‘tag along’ rule for takeovers. This would limit the ability of the controlling family to coerce minorities into unfavourable transactions. We would also be eager to see a change in the deformation law to allow truth as

a defence in any legal case, as is standard in most other countries. While there is a provision for one to say or write something that is in the ‘public good’, it is currently nonetheless unnerving to express views on specific firms in Korea when such legal ambiguity exists. A change in the law would help individuals openly challenge specific governance issues without fear of recrimination.

Frustrations aside, outstanding opportunities exist

For fundamental investors, we believe that some of the most attractive bottom-up opportunities globally reside in Korea. Weak governance is absolutely a frustration we share, but the wholesale depression of Korean valuations heavily overlooks the extensive range of stock specific nuances within the market. Globally leading firms can be acquired at deeply discounted valuations relative to global peers, and this striking dichotomy creates a compelling reason to not overlook this dynamic market.