The South African Election – Shaking the Status Quo

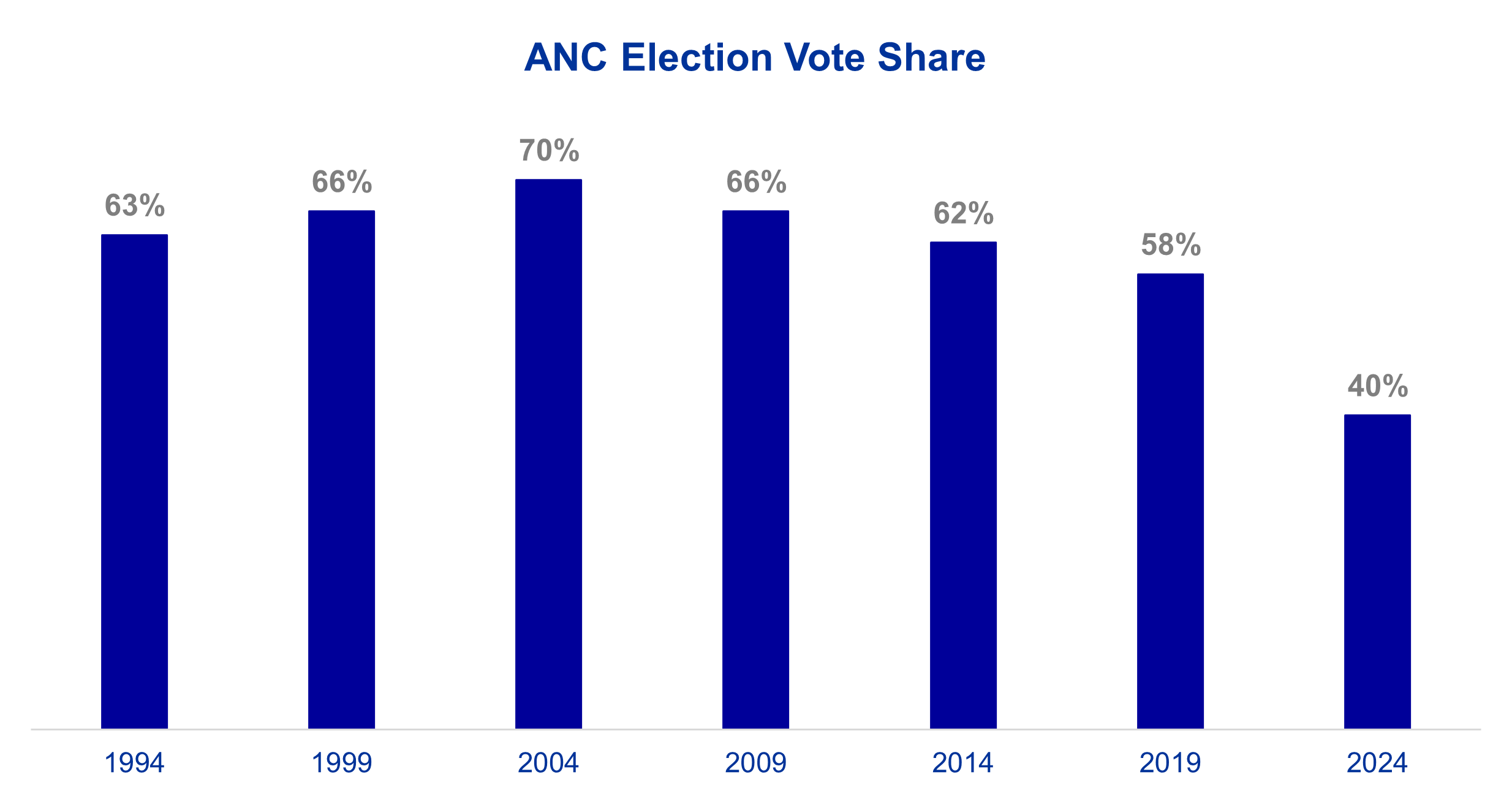

South African capital markets have had a disastrous decade. In a period that the S&P has generated over 12% annualised return, the total dollar return for the South African index has been negative. It is against this backdrop that citizens went to the polls during the last week of May, the outcome fracturing the political status quo. The ANC, a party that had overwhelmingly dominated power throughout the last three decades since apartheid formally ended, fell dramatically short of a majority. This has set the stage for some form of coalition government.

Source: Reuters

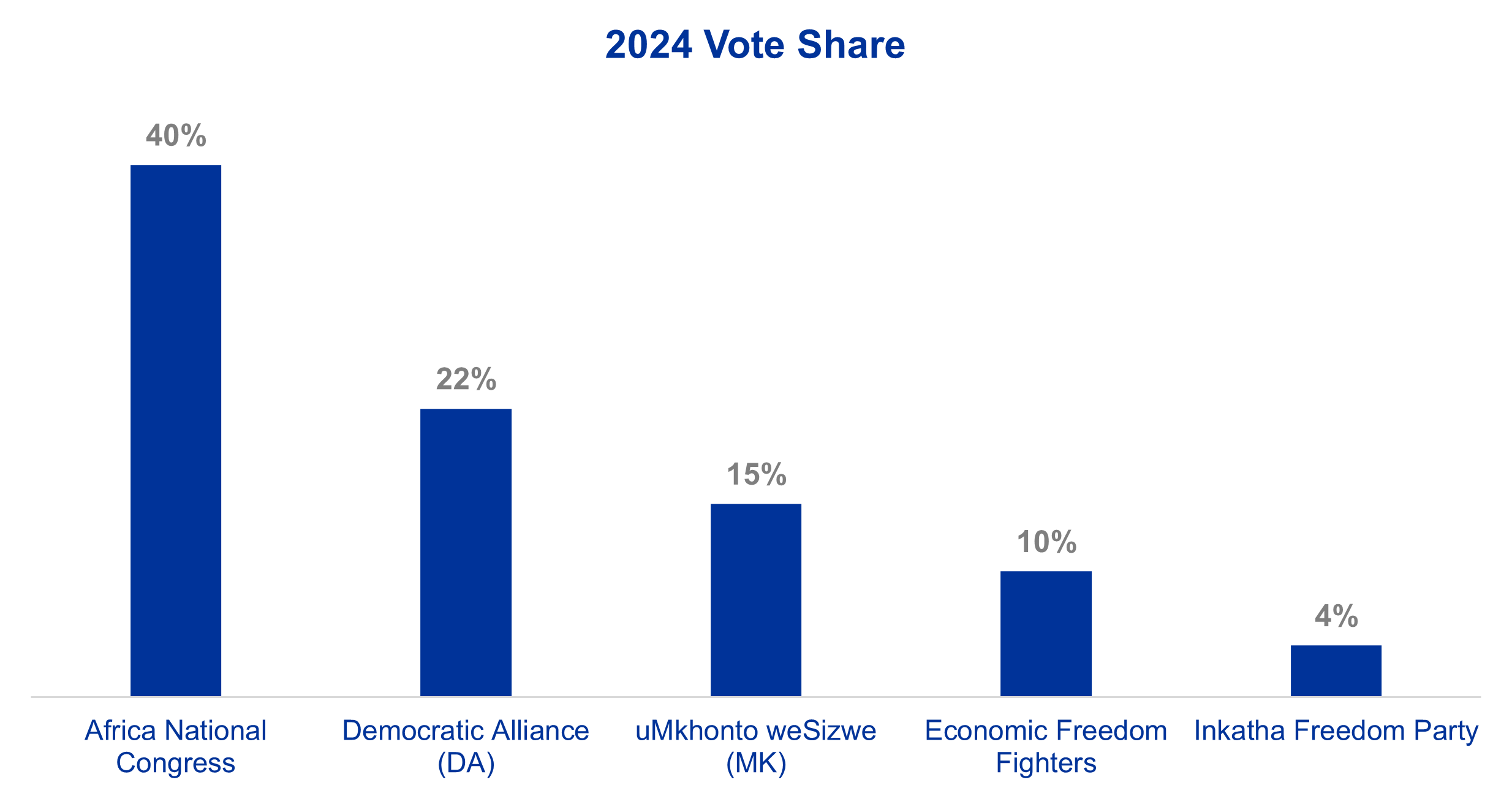

This outcome takes South African politics into unchartered waters. The ‘market’ would very likely favour some form of an alliance with the business-friendly Democratic Alliance (DA) – the party received just over one-fifth of the vote, and have already expressed openness to a pact. Such an alliance however would be uncomfortable, as many ANC voters see the DA as favouring the interests of the white community, while the other minority parties are politically more aligned. There is therefore the real risk that the ANC aligns itself with a more economically extreme party, such as MK and/or the Economic Freedom Fighters – such a move would likely further hurt business confidence.

Source: Reuters

For value investors, a bruised and out-of-favour equity market is often an appealing starting point when seeking new opportunities. This however assumes that challenges are transitory – either companies are under-earning due to cyclical factors or the valuation level of those companies is unreasonably depressed. The challenge with South Africa is that there has been a notable element of structural decay in its prospects, and therefore confidence that a low valuation will yield high subsequent return notably less certain.

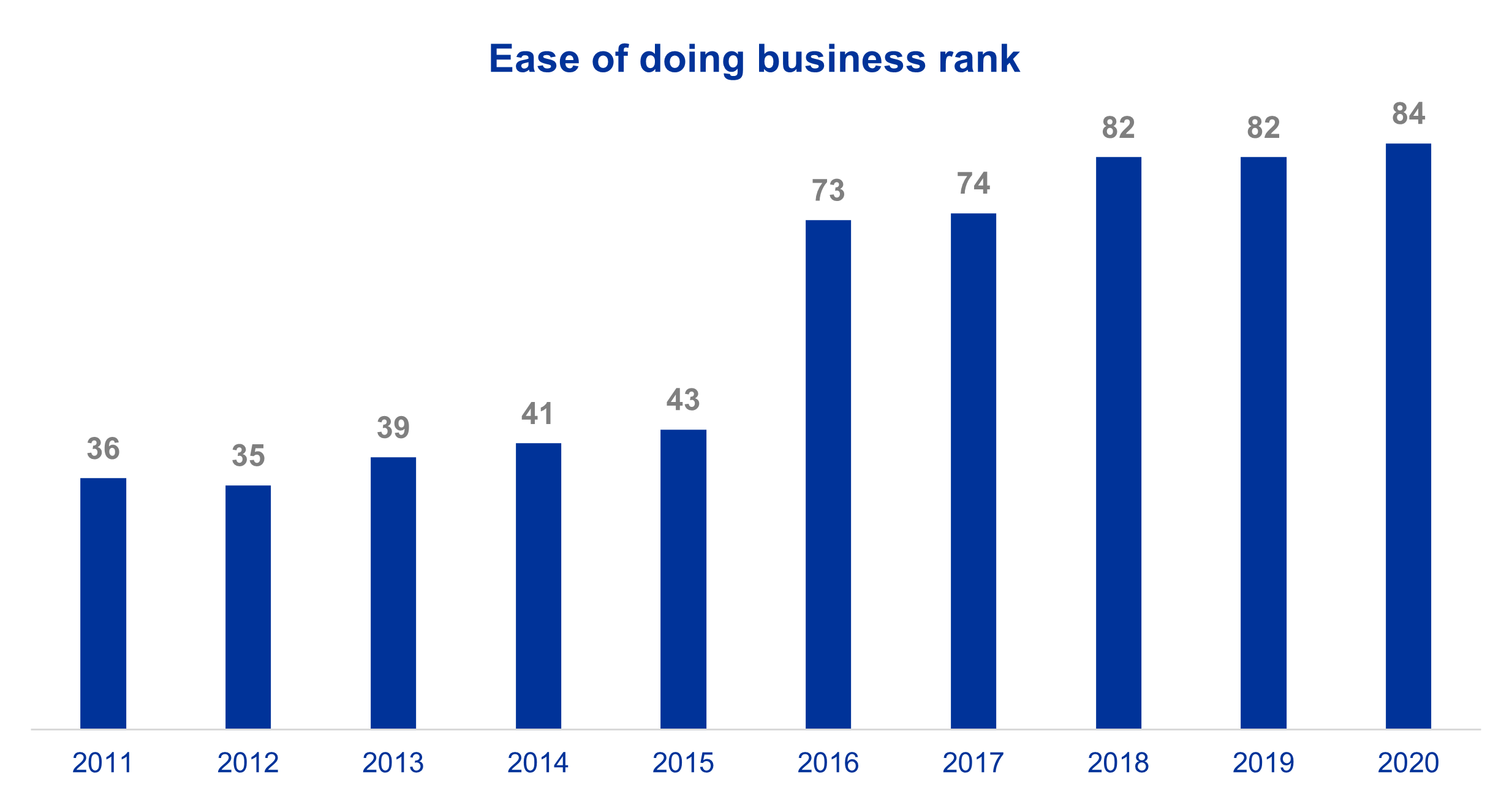

This is of course disappointing. Famously South Africa used to be touted as one of the “BRICS” (Brazil, Russia, India and China) – a term coined in the mid-2000’s to describe the major emerging markets. Progress however has tailed peers, and its economic clout diminished. Domestic challenges have been largely down to poor policy making - blurring lines between state and party, weakening institutions, plus a high level of corruption. This has been coupled with an increasingly hostile business environment, a policy feature that has dropped South Africa from being ranked within the top 40 easiest nations to do business, to over 80th.

Source: Statista, June 2022

As it stands therefore, we currently find more compelling bottom-up opportunities in other emerging markets. While most of these markets are developing off a low-base, they are nonetheless largely improving for the better, and this makes it easier to anchor a robust valuation target to. It remains the case that we don’t make grand predictions around the short-term outlook, but as per our bottom-up valuation models, we remain encouraged that the valuation case for the fund’s holdings remains attractive both on an absolute and relative basis.