In the past several days we have witnessed one of the most significant shocks to global equity markets in the post-World War II era.

Last Wednesday afternoon, in the White House Rose Garden, President Trump unveiled what has increasingly been interpreted as a multi-pronged war on both foreign adversaries and allies, global corporations, and ultimately U.S. consumers. Whilst many had assumed President Trump would provide protection to equity markets, Treasury Secretary Bessent summarised the US administration’s point of view in an interview over the weekend: “Wall Street’s done great. It can continue doing well. But it's Main Street’s turn.”

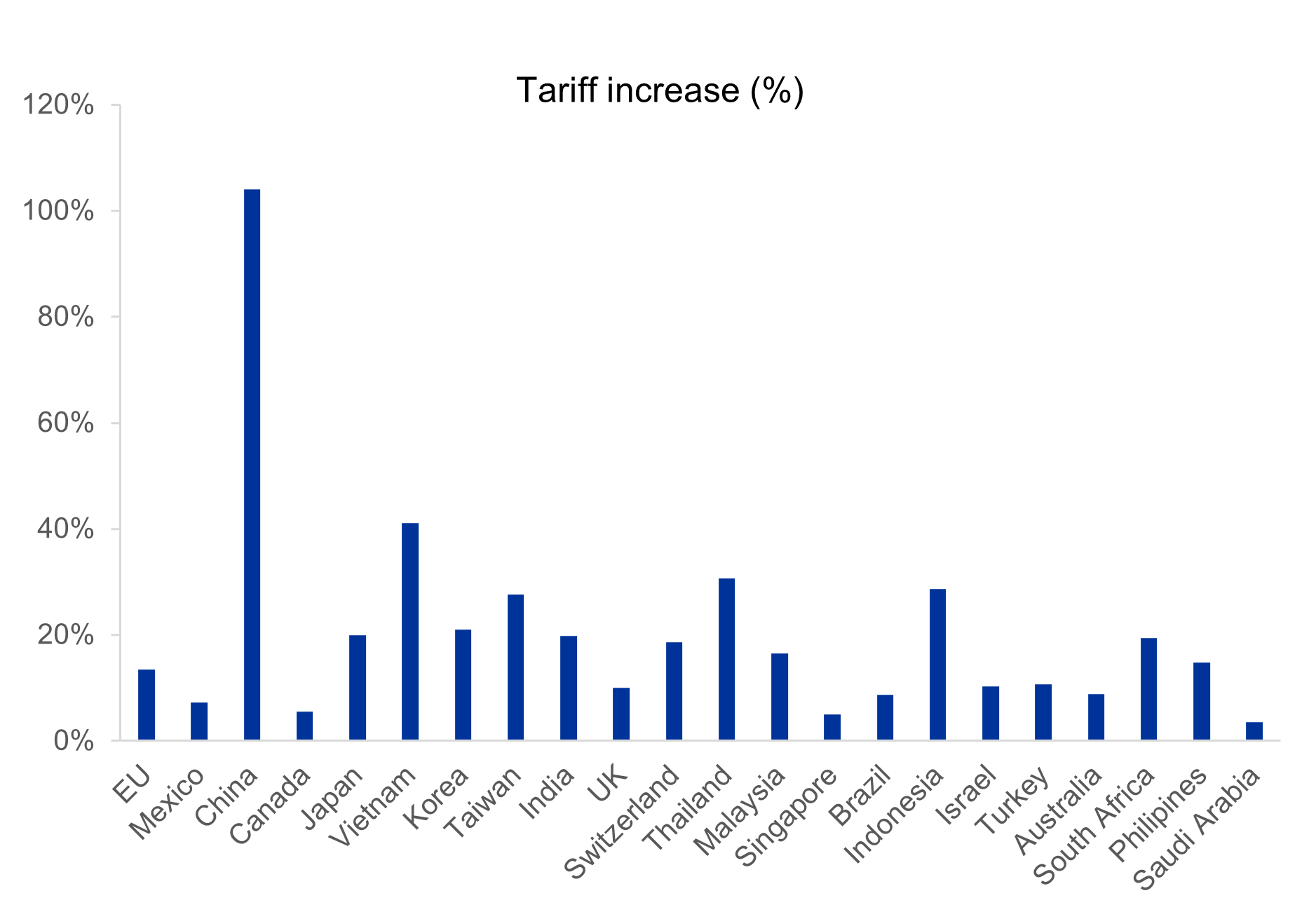

The immediate impacts of the newly imposed tariffs are relatively straightforward: U.S. importers must now pay a tariff at the U.S. border, with the tariff rate largely dependent upon the prevailing trade deficit of the exporting nation with the United States. A summary of all the tariffs announced to date can be seen in the table below.

Source: Goldman Sachs.

Note: The tariff increase reflects the change in average rates based upon all announcements since the inauguration of President Trump.

Enacting blanket tariffs in this way may seem indiscriminate, however the resulting impact on a country, sector and company basis is nuanced. With a concentrated portfolio of 25 holdings, diversified across countries and sectors, we can work through the implications on a company-by-company basis.

Few holdings in the portfolio suffer directly from the consequences related to these new tariffs but one example is Samsung. Samsung exports televisions, mobile phones, and other electronic devices into the U.S., and will face additional costs. However, Samsung’s largest business segment, semiconductor manufacturing, remains exempt from these tariffs, although most of its semiconductor products are not directly sold into the U.S. market.

The bigger impact to the portfolio came from the expectation of a potential negative demand shock. Markets have quickly priced in anticipated demand declines—oil prices, for example, have fallen twenty percent over the last week, adversely impacting our energy holdings, and resulting in their notable underperformance in recent days.

Beyond these immediate impacts lies significant complexity nuance related to supply chain disruptions and shifts in the global competitive landscape. A relevant case in point is ArcelorMittal. Arcelor has limited operations in the US but imports some products to the US from Canadian and Mexico plants. During 2018/19 Trump imposed tariffs which increased costs $100m per quarter but this was more than offset by price increase. This time round US steel prices have already increased by +40% to reflect the new tariffs. We continue to believe that Arcelor is a structural winner from fracturing global trade. There is globally 600m tons of excess capacity in the steel industry and imposition of tariffs could rebalance the industry’s cost curve significantly.

As we move beyond these immediate and secondary effects, we evaluate tertiary implications, including political and policy reactions both within and beyond the United States. Domestic response to tariffs remains uncertain. There are potential mechanisms for congressional intervention, possibly through budget negotiations or pending tax legislation requiring congressional approval. Further, Federal Reserve actions remain contingent on whether the tariffs become inflationary or deflationary.

Another critical consideration is the potential for either negotiated resolutions or escalating retaliatory measures. Thus far, China has engaged in tit-for-tat trade actions. One Chinese economist with strong government links described the trade war as not simply an economic friction but “a war without smoke.” The broader international community’s response remains uncertain. Markets may already be discounting the risk of further escalation rather than, perhaps equally likely, de-escalation.

Given the risk of material downside our primary emphasis remains risk management. We remain focused on companies with strong balance sheets, flexible cost structures, and high operating margins, attributes we believe will provide resilience against the increased range of potential economic outcomes.

Yet, amid the challenges, opportunities inevitably arise. We have been writing for some time about disparities in valuations, the recent market turmoil has lowered valuations which will create attractive entry points. Opportunities may exist in domestic European and Japanese companies that are relatively insulated from direct tariff impacts, and in some instances may benefit, yet they have nonetheless experienced indiscriminate declines. Examples of such investments in the portfolios include European airlines, as well as UK based hotel operator Whitbread.

In summary, while the recent tariff-driven volatility undeniably introduces significant uncertainty, it concurrently creates compelling opportunities. This environment underscores the benefits of a concentrated portfolio, focused on resilient businesses whose long-term value has been temporarily overshadowed by short-term market disruptions.